Isn’t it interesting that an industry that requires its founders to be data-driven, isn’t itself.

Venture Capital firms are ignoring evidence that a company is often more successful when it has at least one female founder or a female CEO. The evidence is significant.

Female Founders Perform

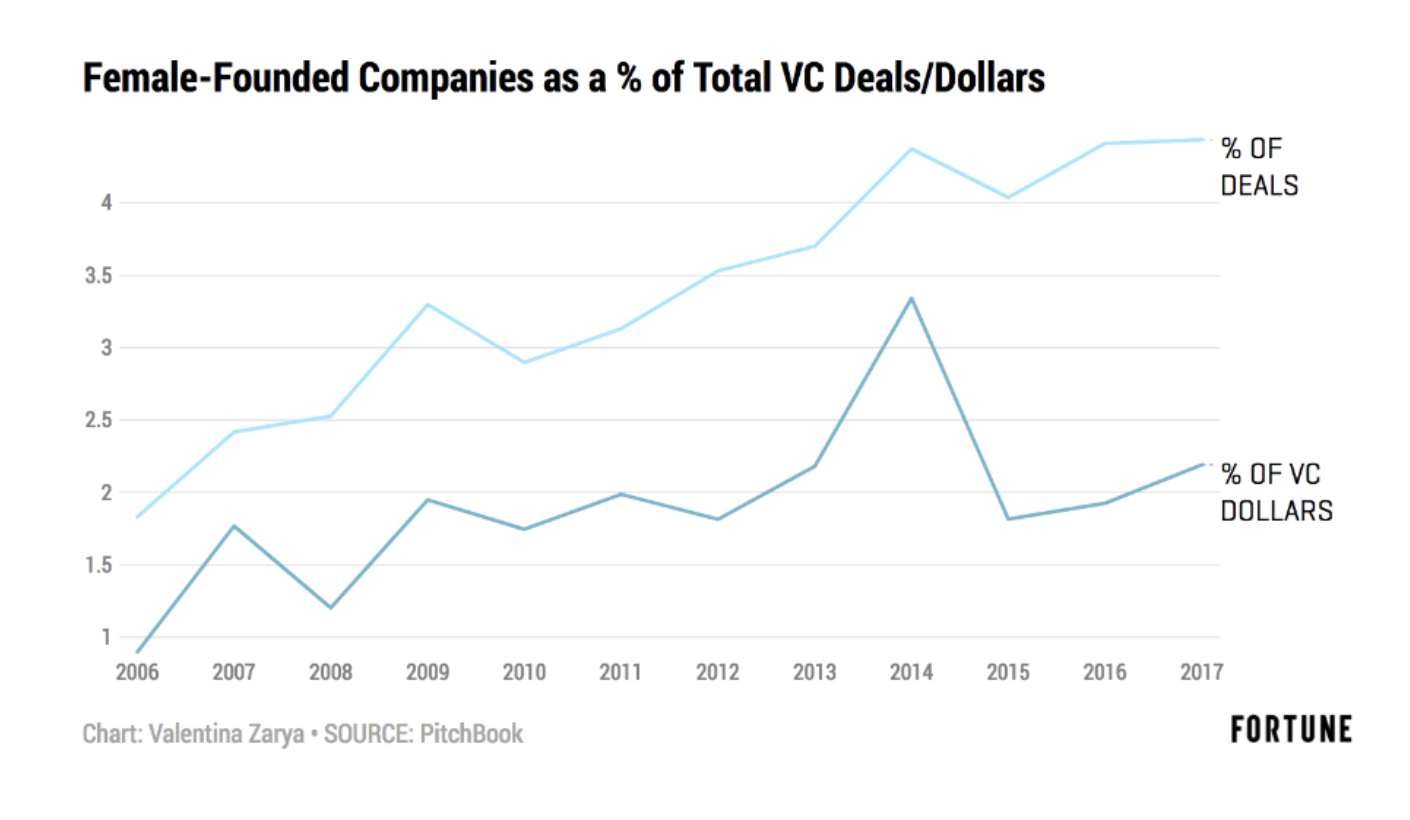

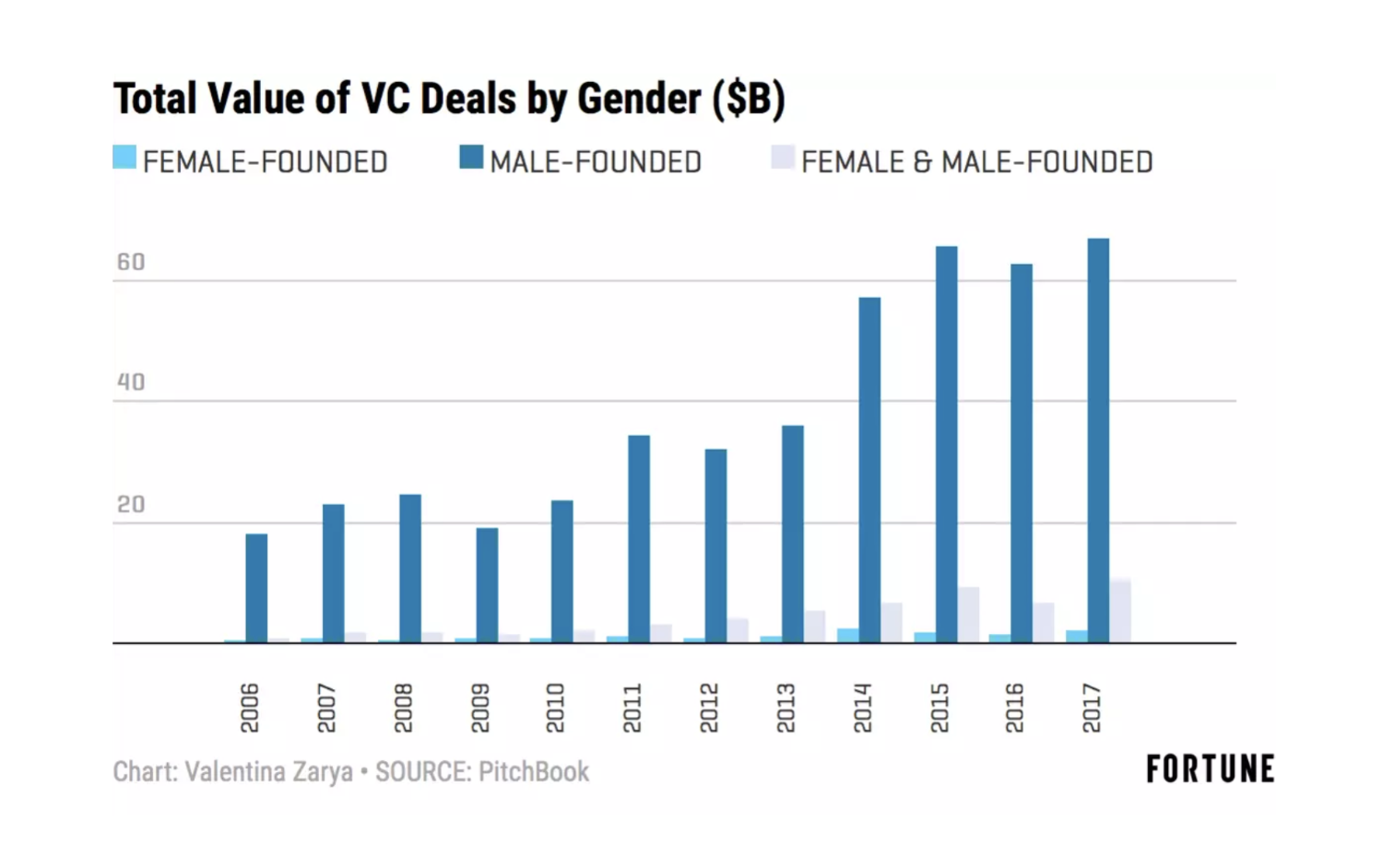

This is post #2 regarding raising capital as a Female Founder (you can read my first instalment here). We are targeting raising a million dollars, which will allow us to build out the company infrastructure, focus on customer acquisition, and get to our next key building stage. I noted in the previous post that female founders received about 2% of VC funding, despite owning 38% of businesses (HBR). Fortune says this also held true in 2017 with female founded companies receiving 2.2%. Unbelievably, just 8% of companies funded by VCs have female partners (HBR), while 17% of startups have a female founder (Techcrunch). Yet, in our small startup we have three female founders. Forbes, however, says there was a “silver lining” in 2017: With the exception of 2014, companies run by women received their largest share of VC dollars — 2.2% of the dollars and just under 5% of the deals done. Deep sigh. Not much of a silver lining.

VCs ignore the stats

The numbers are disappointing but not surprising. Data-driven VCs seems to ignore statistics that show that investing in female founded companies leads to positive results. This week, I had a conversation with a man who is well-connected in the NY VC world who offered this insight, “Men won’t invest in what they don’t understand.” Oftentimes, companies with female founders are solving women’s problems. Think bra’s, styling, and companies like Thinx, the bold and unabashed period underwear, or Peanut for mama’s looking to meet their peers, or Thirdlove which sells underwear. Apparently, men turn off quickly if the solution being offered is female gender specific. This explanation makes sense to me, however, there is a deeper issue since the largest segment of female founded companies that received funding are in tech and are gender neutral. On the one hand, this validates the point that men are more likely to invest in something that is gender neutral or that they can understand. But on the other hand, this implies that there are many companies still not being funded if they are led by at least one female founder even in gender neutral businesses.

Yet:

- Companies with at least one female founder “out-performed their male counterparts by 63%” creating shareholder value (First Round)

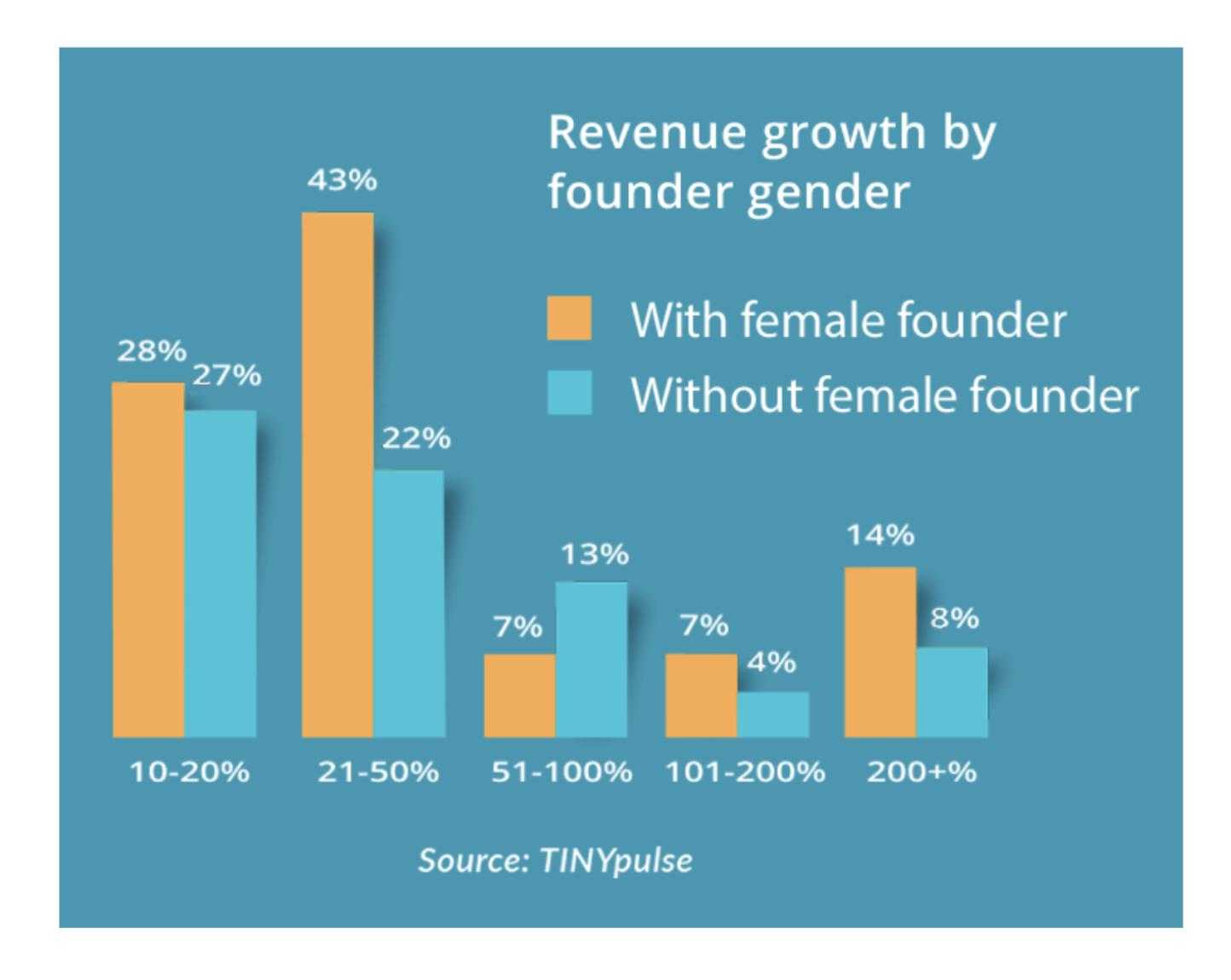

- As the chart below shows, “at four out of five high-growth revenue measures, female-founded companies showed stronger overall performance. (Tinypulse)

- The fastest growing companies at 200%+ growth, are 75% more likely to have a female founder.” (Tinypulse)

- “For profitable firms, a move from no female leaders to 30% representation is associated with a 15% increase in the net revenue margin.”(MCSI)

There is no explanation for why startups with female founders perform better but they often do. “Firms with a woman running the show perform far better than the market.”(Fortune). Perhaps this is due to diversity of thought. Perhaps this is due to the fact that women tend to be more realistic with their projections. Perhaps this is due to the fact that women balance data with intuitiveness or “gut.” Whatever the reasons, I hope that 2018 is the year that the tides begin to shift in favor of female founders.

iSPY is an image tech company, so aside from our founding team and a penchant for punchy, feminine hues of pink and purple, we’re pretty gender neutral in the service our product delivers. We are also part of a slowly growing wave of businesses that are set on disrupting a large industry. Positioned to take advantage of an emerging segment, we sit right between buyers and sellers to create a network effect. After my calls this week, I am convinced that investors like our business model. I am also convinced that most investors will be looking for reasons not to invest. Our team is evaluating everything from location, to tech platform, to business inflection points. Hopefully, these steps will help us become one of the small percent of funded companies run by women. Fingers crossed!

Leslie Hughes is the CEO and Founder of iSPY Technologies, Inc. and iSPY Visuals, an intelligent search tool and workspace for visual content users. Hughes has over 20 years experience in digital media licensing, content production, and distribution, including having been President of Bill Gates’ Corbis Images, and President of the Markets and Products Group for Corbis Corp. She became an entrepreneur 10 years ago. Hughes has consulted or been part of 6 start-ups and 12 acquisitions. She has an MBA from the Cox School of Business at Southern Methodist University, is the proud mother of two and lives and works in New York.

Connect with Leslie: Twitter | LinkedIn | Angel List